1

Please refer to important disclosures at the end of this report

1

1

Update on Government stimulus – Part II

Size of economic stimulus announced is below market expectations

The Finance minister has announced an economic stimulus package of ` 11 lakh

cr. between the 13

th

and the 17

th

of Mar’20. Including various measures

announced by the RBI & government earlier total size of the economic package

works out to INR 21 lakh cr. Markets have however been disappointed by the

package given that it relies more on providing credit to the markets and the lack of

actual cash spending and far reaching reforms by the Government.

Other than the lack of cash spending the markets have also been disappointed by

the size of the new measures announced as it is also includes liquidity measures of

` 2.8 lakh cr. announced by the RBI prior to the 27

th

of Mar’20 which was not in

line with market expectations.

Increased borrowing limits for states linked to structural reforms

However there are some key proposals in the form of structural reforms in

Agriculture and power sector which would be very positive for the economy in the

long run. The Government has said that it will amend the essential commodities

act and also undertake long standing demand for agriculture market reforms

wherein Agriculture food stuffs including cereals, edible oil, oilseeds, pulses,

onions and potato will be deregulated.

The Government has also accepted state governments demand for increase in

their borrowing limit to 5% of Gross State Domestic Product (GDSP) from 3% of

GDSP for FY2020-21 in order to make up shortfall in revenues due to economic

slowdown. However only 0.5% increase in borrowing limit will be unconditional

and the balance of the additional borrowing limits will be linked to specific reforms

in the areas of universalisation of ‘One Nation One Ration card’, Ease of Doing

Business, Power distribution and Urban local body revenues.

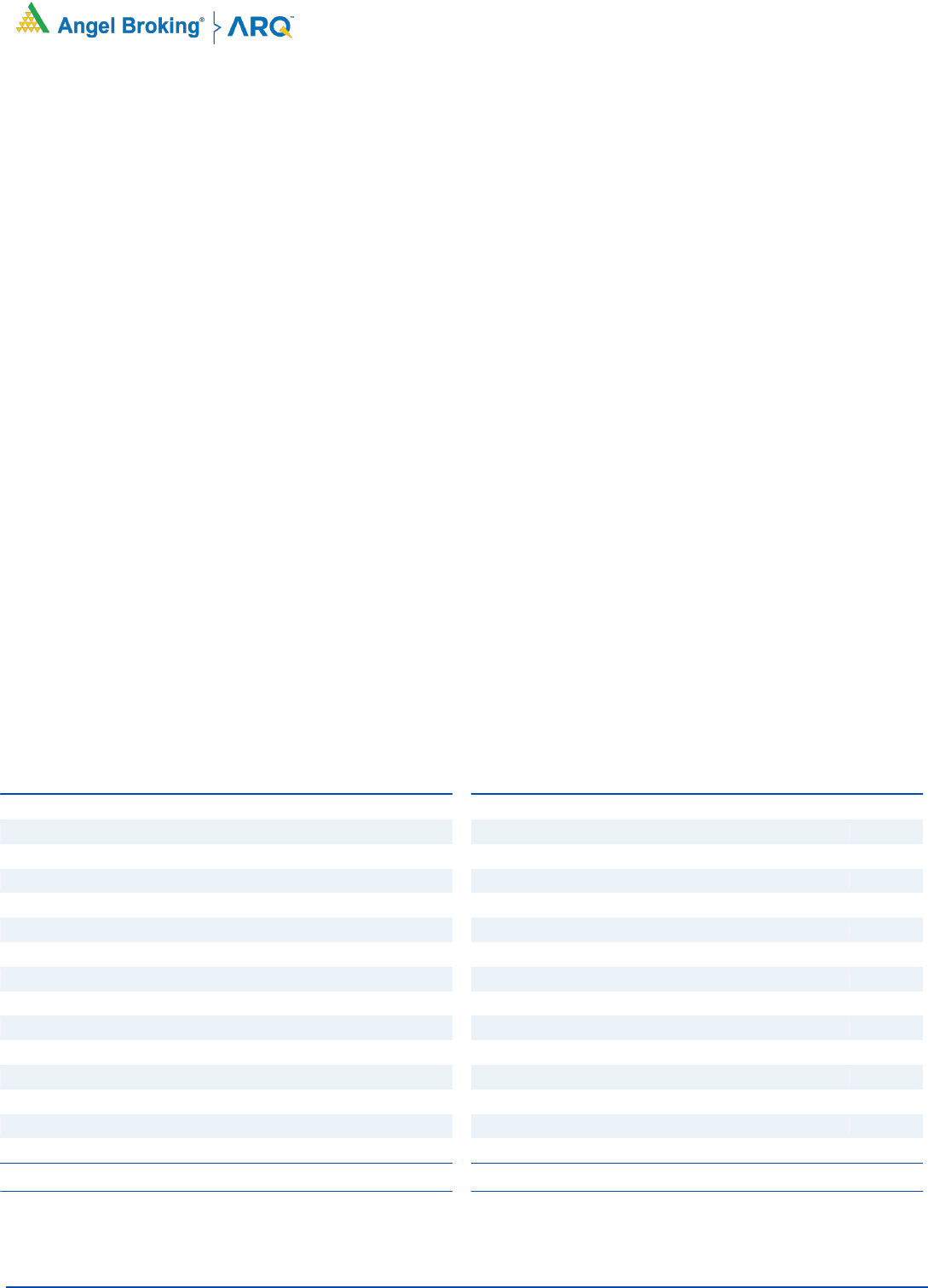

Exhibit 1: List of announcement in stimulus 2.0 (` cr.)

Collateral free Govt guaranteed loan for business\MSME

300,000

Concessional credit to farmers through PM KISAN card

200,000

Fund for strengthening farm gate infra

100,000

Liquidity support for DISCOM

90,000

Credit linked subsidy scheme for real estate

70,000

Equity infusion for MSME through FoF

50,000

TDS/TCS reduction

50,000

Partial credit guarantee scheme for NBFCs

45,000

Additional MGNREGA allocation

40,000

Standing liquidity facility for NBFCs/HFCs/MFIs

30,000

Additional Funding for farmers through NABARD

30,000

Subordinate debt for stressed MSME

20,000

PM Mastya sampada yojna

20,000

Animal husbandry infra development fund

15,000

Other Measures

42,650

Total

1,102,650

Source: Company, Angel Research

Exhibit 2: Total stimulus so far (` cr.)

Fiscal Measures announced by RBI so far

Measures announced by RBI Prior to 27th Mar'20

277,553

CRR cut (27th Mar'20)

137,000

MSF increase (27th Mar'20)

137,000

TLTRO (27th Mar'20)

100,050

TLTRO - small NBFC (17th Apr'20)

50,000

Refinance facilities to NABARD SIDBI NHB (17th Apr’20)

50,000

Standing liquidity facility - MF (26th Apr’20)

50,000

Total RBI measures so far

801,603

Fiscal package announced by the Government

Fiscal package by the Government (27th Mar’20)

192,800

Total package announced on 13th May’20

594,550

Total package announced on 14th May’20

310,000

Total package announced on 15th May’20

150,000

Total package announced on 16th & 17th May’20

48,100

Total

2,097,053

Source: Company, Angel Research

New measures aggregating to ` 11

lakh cr. is below market expectations

Proposed structural reforms on

agriculture & power sector are long

term positives

Additional borrowing limits for states

to mitigate shortfall in revenues

2

Error!

Refer

ence

sourc

Update on Government stimulus – Part II

May 18, 2020

2

Economic package unlike to stimulate demand immediately

While the stimulus of ` 21 lakh cr. by the Government at 10% of GDP may seem

large it is still smaller in size as compared to the stimulus packages announced by

other countries like the US which has announced monetary and fiscal stimulus of

~25% of GDP so far with more expected to follow. Our stimulus also relies more

on providing credit to the economy and little in the way of cash spending by the

Government. The package also includes earlier measures announced by the RBI &

government and therefore the quantum of new measures are much lower at ` 11

lakh cr. (~5.5% of GDP).

Given that the Government lacks fiscal space to provide direct stimulus to the

economy in the form of cash spending we believe that they are trying to do the

next best thing by ensuring adequate credit flow to essential sectors like

agriculture, MSME and Power in order to ensure that the economy doesn’t come to

a standstill. Effectiveness of the measures announced so far will depend on the

actual flow of credit to the economy given that banks have been so far risk averse

in lending.

Increase in state Government borrowing limits too have been tied up to market

reforms on agriculture and power sector which should force the state Governments

to do structural reforms which have been long pending. We believe that this will

force state Governments to implement tough structural reforms which will benefit

the economy in the medium to long term.

Easing of lockdown is positive though concerns still remain

The Government has also announced an extension of lockdown till the 31

st

of May

2020 though with greater relaxation. The Government has either fully or partially

lifted some of the restrictions subject to state approvals. Some of the key changes

are listed below:

Allowing intra state movement of people using passenger vehicles and buses

as decided by the states. Interstate movement of people will also be allowed

based on mutual consent of the states/UT involved.

All non essential shops are allowed to open except for those within malls and

containment zones.

Delivery of non essential items by e-commerce platforms while restaurants will

be allowed to operate kitchens for home delivery only.

There have been other minor relaxations allowed by the Government though

significant portion of the economy including educational institutions, domestic &

international air travel, malls, hotels and metro rail services will remain closed.

Therefore we expect a very gradual rebound in economic activities from here on as

more businesses resume operations in a phased manner.

However there has been a mass movement of migrant workers from urban to rural

areas over the past week as they returned to their hometown. While rural areas

have largely remain unaffected from the virus there is a possibility that there could

be a surge in new cases after a few weeks if there is a spread of the virus from

urban to rural areas. If that were to happen then the recovery will get derailed as

Governments could be forced to roll back some of the relaxations.

New measures announced by

Government at ~5.5% of GDP is

inadequate

Linking borrowing limit to reforms

may force states to implement

structural reforms

Easing of restrictions would lead to

increased economic activities

However significant portion of

economy still remains shut and

recovery to be gradual at best

Spread of virus from urban to rural

areas is the biggest risk

3

Error!

Refer

ence

sourc

Update on Government stimulus – Part II

May 18, 2020

3

View and outlook

We believe that the agriculture sector is the biggest beneficiary of the package

announced so far as significant portion of the measures announced were directed

at the sector. Change in definition of MSME would make more companies eligible

for taking loans which along with credit guarantees provided by the Government

may spur lending to some extent. However the package announced by the

Government has fallen well short of market expectations given lack of any major

announcement on cash spending.

Therefore post the announcements we continue to prefer businesses which are

either engaged in essential activities or could benefit from increased digitization.

We maintain our preference for sectors like agrochemicals, chemicals, FMCG,

pharma, telecom and IT which have better revenue visibility. We also maintain our

strategy of avoiding sectors which are vulnerable to the slowdown like aviation,

automobiles, hospitality, banks & NBFCs given extension of lockdown.

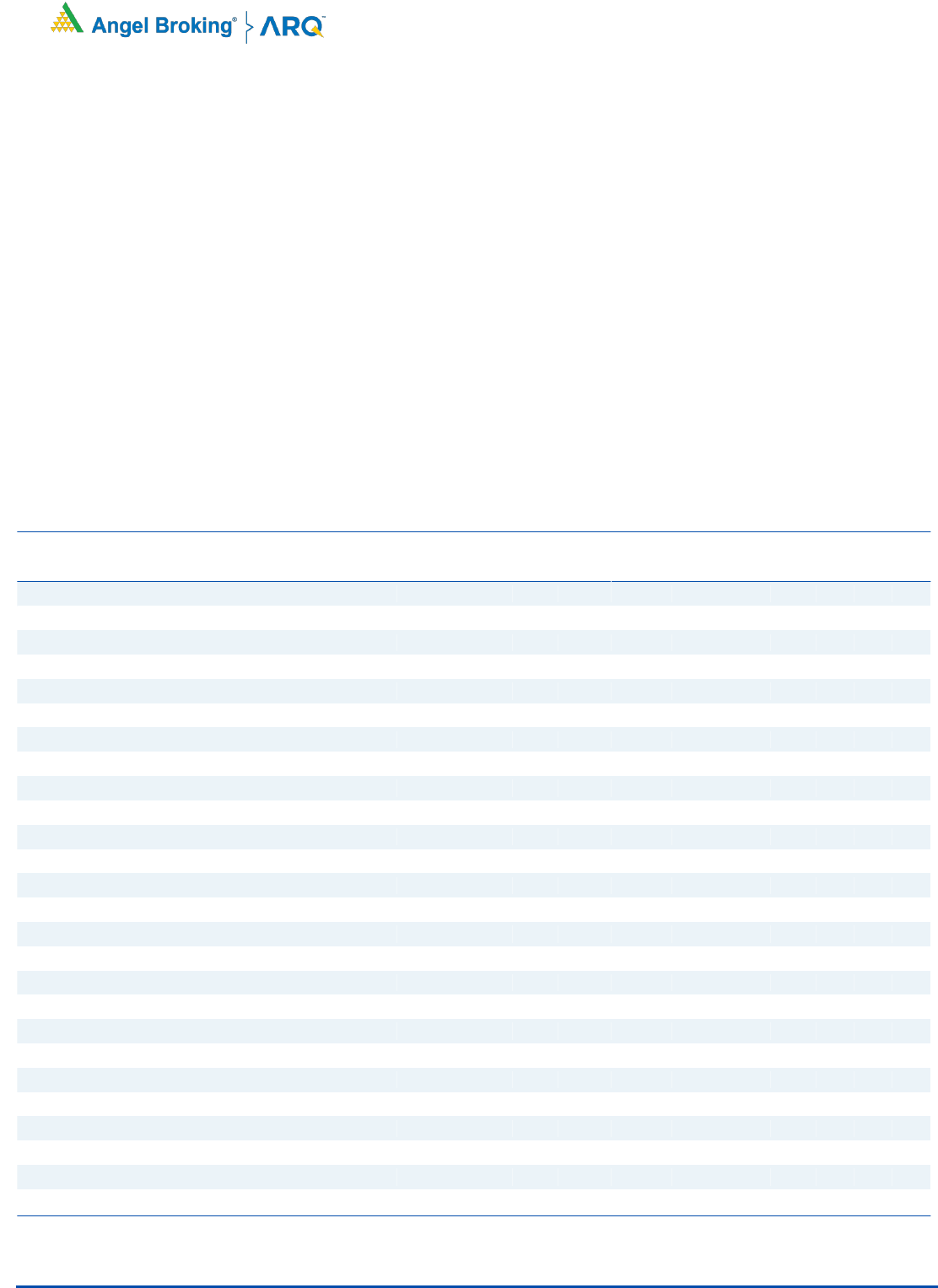

Exhibit 3: List of stock recommendations

CMP

(`)

Target

Price (`)

Sales

(`)

OPM (%)

PAT

(`)

ROE

(%)

P/E (x)

EV/Sales

s(x)

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FMCG

Britannia Ind.

3,110

3,550

13,255

14,863

16.3

16.7

1,622

1,901

30.2

29.6

46.6

39.7

5.6

5.0

Colgate-Palmolive

1,380

1,522

4,827

5,213

27.4

27.9

855

938

40.4

37.7

42.9

39.1

7.6

7.1

Hindustan Unilever

2,006

2,294

40,778

44,855

24.6

24.8

7,024

7,809

64.3

61.7

62.7

55.9

11.5

10.4

Nestle India

16,240

19,100

13,235

14,558

22.7

23.3

2,091

2,333

34.9

31.3

74.9

67.1

11.4

10.2

P& G Hygiene

10,077

11,782

3,365

3,802

22.2

22.6

549

637

29.0

24.6

59.6

50.7

9.8

8.7

Other Consumer Goods

Avenue Supermarts

2,306

2,705

27,208

33,238

9.0

9.0

1,470

1,800

17.5

17.7

87.3

71.4

5.6

4.4

Bata India

1,282

1,592

3,359

3,762

27.7

27.7

434

518

17.9

18.1

37.9

31.8

5.2

4.1

Hawkins Cookers

4,262

5,117

768

876

15.1

15.1

82

94

45.0

42.2

27.6

24.1

2.9

2.5

Chemicals/Agro Chemicals

Aarti Industries

1,001

1,284

4,822

5,886

21.7

22.2

538

711

16.8

19.6

33.9

25.6

3.7

3.0

Dhanuka Agritech

492

589

1,217

1,304

16.0

16.4

150

165

22.6

22.8

15.5

14.0

1.9

1.8

Galaxy Surfacants

1,283

1,610

2,672

2,886

14.0

14.3

221

223

18.3

17.8

20.4

18.3

1.8

1.6

PI Industries

1,459

1,784

3,877

4,992

21.5

22.5

555

770

17.4

20.0

36.3

26.2

5.1

3.9

IT

Infosys

664

841

90,650

102,857

21.3

20.5

16,200

17,870

28.1

30.5

17.4

15.8

2.8

2.5

L&T Infotech

1,645

1,832

11,352

12,828

18.1

19.0

1,486

1,771

21.6

21.9

19.3

16.2

2.2

1.9

Pharma & Healthcare

Alkem

2,338

3,300

9,860

11,309

17.5

18.0

1,279

1,419

18.3

17.8

22.1

21.0

2.5

2.2

IPCA Labs.

1,596

1,900

5,360

6,111

22.5

23.0

821

976

18.8

18.6

24.3

20.4

3.9

3.4

Telecom/ Others

Bharti Airtel

538

629

99,530

111,755

44.4

45.6

4,405

8,171

3.7

7.1

90.0

43.6

3.7

3.1

Reliance Industries

1,441

1,758

373,215

457,539

13.8

13.3

30,272

37,510

6.4

7.8

30.2

24.4

4.9

4.0

Source: Company, Angel Research

Note: CMP is Closing price as of 18

th

May, 2020

Agriculture sector is the biggest

beneficiary of Govt. package.

We continue with our strategy of

focusing on business with better

revenue visibility

4

Error!

Refer

ence

sourc

Update on Government stimulus – Part II

May 18, 2020

4

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)